Stop the Stress: Simplify Your Money, Simplify Your Life

If you’ve ever tried to manage your money with complicated spreadsheets, endless categories, or restrictive rules that you just can’t stick to, you know the truth: traditional budgeting often leads to burnout, not financial peace.

We believe that a budget should be a tool for freedom, not a form of financial punishment. That’s where minimalist budgeting comes in. It’s the intentional art of cutting the financial clutter, eliminating unnecessary complexity, and focusing your precious resources only on what truly matters.

This isn’t about deprivation; it’s about defining your values and funding them without stress. By the end of this guide, you will have a clear, actionable 5-step blueprint to build a budget that is simple, sustainable, and actually works.

Why Minimalism Works for Finance: The Intentionality Factor

Minimalist living is often associated with decluttering your home. But the most powerful place to apply minimalist principles is your bank account.

The core principle of a minimalist budget is intentionality. You stop spending on autopilot and start aligning every dollar with your core life goals—be they early retirement, travel, or simply more quality time with your family.

By simplifying your finances, you gain three major benefits:

- Reduces Decision Fatigue: Fewer categories and rules mean less time spent agonizing over small purchases. You set the limits once and stick to them.

- Creates Clarity and Peace of Mind: When you know exactly what your money needs to do, the stress and anxiety around unexpected expenses drastically drop.

- Allows You to Fund Your Values: By eliminating low-value “fluff” spending, you free up significant resources to dedicate to high-value goals.

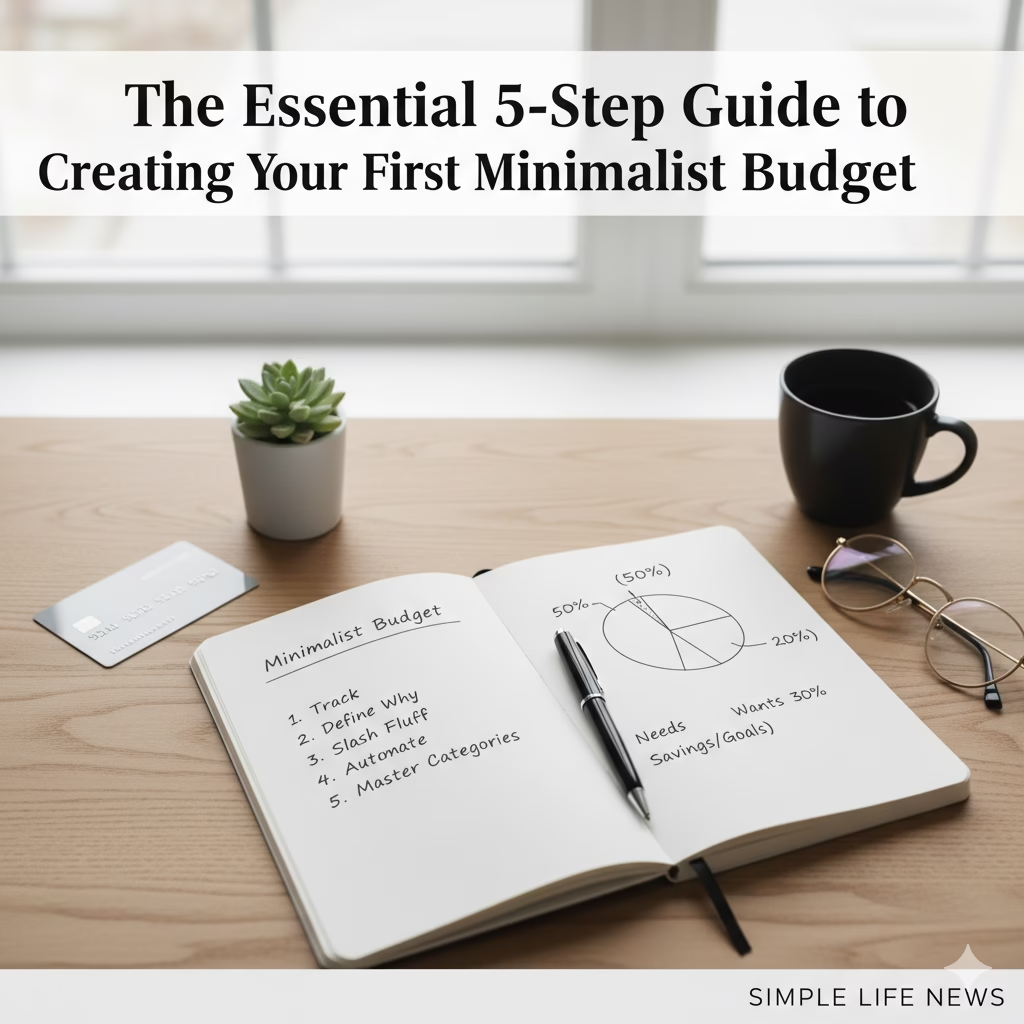

The Essential 5-Step Guide to Your Minimalist Budget

A minimalist budget is built on a strong foundation of awareness, goals, and automation. Follow these five essential steps to transform your financial life.

Step 1: Track for Clarity, Not Judgment

The first rule of simple money management is: You must know where your money is going. You can’t simplify what you don’t understand.

For 30 days, make a strict commitment to track every single expense. The key here is to keep the tracking system as minimalist as possible:

- Avoid Complex Software: Use a single, reliable method, whether it’s a simple spreadsheet, one budgeting app, or even a notebook.

- Broad Categories Only: Do not create a hundred different categories. Use the simple, powerful three-category framework:

- Needs (50%): Rent/Mortgage, Utilities, Groceries, Transportation, Minimum Debt Payments.

- Wants (30%): Entertainment, Dining Out, Shopping, Subscriptions.

- Goals/Savings (20%): Emergency Fund, Investments, Extra Debt Payments.

Actionable Tip: At the end of the 30 days, calculate your spending by percentage. This simple exercise provides more clarity than a year of trying to guess where your money went.

Step 2: Define Your “Why” and Set 3 Core Financial Goals

Many budgets fail because they are just lists of numbers. A successful budget is tied to an emotional “why.” This step links your spending back to the simplicity and minimalism you crave in life.

Don’t set 15 vague goals. Focus on 3 BIG, high-priority targets:

| Goal Type | Example | Minimalist Focus |

| Short-Term (0-1 Year) | Build a $5,000 Emergency Fund | Stability, Anxiety Reduction |

| Mid-Term (1-5 Years) | Pay off the credit card debt | Eliminating Clutter, Freedom |

| Long-Term (5+ Years) | Save for a Down Payment on a house | Intentional Future Planning |

Your 3 goals are now the filter through which all discretionary spending must pass. If a purchase doesn’t align with these goals, it is financial clutter and should be eliminated.

Step 3: Slash the “Fluff” (The 10% Challenge)

Minimalism is about ruthlessly eliminating the non-essential. In finance, this means attacking subscriptions, auto-renewals, and habitual low-value purchases.

Take the 10% Challenge: Can you immediately cut 10% of your current monthly Wants spending?

- Audit Subscriptions: List every single subscription (streaming services, boxes, apps). Cancel anything you haven’t used in the last month.

- Negotiate: Call three service providers (internet, phone, insurance) and ask for a lower rate or a competitive deal. This is often the fastest way to save hundreds per year.

- Cut the Auto-Spend: Reduce your eating-out budget by half and replace it with planned, enjoyable meals at home.

When you simplify your expenses, you free up money to work toward the high-value goals you defined in Step 2.

Step 4: Automate Your Intentions (Pay Yourself First)

The secret to a stress-free budget is making sure the important things happen without daily effort. Use automation to put your savings and debt repayment goals on autopilot.

- Set up Auto-Transfers: The day your paycheck hits your account, automatically transfer the money designated for your 3 Core Goals (Step 2) and your fixed bills (Step 1) to their respective accounts.

- Use Separate Accounts: A separate high-yield savings account for your Emergency Fund and a dedicated investment account for retirement can minimize the temptation to touch that money. Out of sight, out of mind—the minimalist way.

Once the “Needs” and “Goals” are covered automatically, the money left in your checking account is your guilt-free discretionary spending for the month. This drastically simplifies day-to-day decisions.

Step 5: Implement the “Master-Category” Budget

Forget tracking every latte and every roll of toilet paper. A minimalist budget requires only a quick, high-level check-in.

Instead of 20 detailed categories, stick to your 4-5 broad Master Categories (e.g., Housing, Food, Transportation, Goals, Discretionary).

- Weekly Check-in: Dedicate 10 minutes every week (Sunday evening is perfect) to quickly review your Master Categories. Are you on track? Did you overspend on groceries? Adjust your Discretionary fund immediately to compensate.

- Zero-Based Simplicity: If you follow the previous steps, you should operate on a zero-based budget where your Income – Expenses – Savings/Goals = Zero. This gives every dollar a job, ensuring no money drifts into thoughtless spending.

Final Thoughts: Simplicity Leads to Wealth

A minimalist budget is more than just a financial tool; it’s a commitment to a simpler life. By implementing these 5 steps, you eliminate the constant stress of complicated tracking and free up your mental energy to focus on the things that bring you genuine joy.

You’re not budgeting to be broke; you’re budgeting to be free. Take the first step today.

Which of the 5 steps was the biggest revelation for you? Share your biggest win in the comments below!

Subscribe to SimpleLifeNews for more simple tips on finance, minimal living, and intentionality!

Did you like it? Read more news like this.

Share it with your friends.